The $13 Billion Mystery Angels

For many years, a Los Angeles psychoanalyst to the stars named Milton Wexler led the fight against Huntington’s disease, a rare and fatal congenital illness. His Hereditary Disease Foundation didn’t have much money, so he attracted scientists to his cause by inviting them to parties where they could mingle with his celebrity friends.

In 1997 a single donor began charting a new direction for the research effort into Huntington’s. He poured millions and eventually hundreds of millions of dollars into an aggressive search for a cure. At first he worked with Wexler’s organization, then split off and established his own network of nonprofit foundations. He hired a former banker named Robi Blumenstein to run them. In place of Wexler’s salons, where the talk had flowed freely from chromosomes to the arts, Blumenstein offered conferences with PowerPoint presentations on promising therapies and partnerships with major drugmakers such as Pfizer. “The word on the street was, wow, this is great. There’s this rich guy who’s creating this virtual biotech that’s tackling H.D.,” says Nathan Goodman, a scientist in Seattle. “My God, our prayers have been answered.”

By 2011 the donor was spending more than $100 million a year on Huntington’s, more than the National Institutes of Health was investing in a cure. Like everyone else, Goodman was grateful for the infusion of money—the disease had killed his father-in-law. He nevertheless found it frustrating that he couldn’t talk to the donor about his spending priorities. He says he grew more curious when he noticed Blumenstein at research conferences accompanied by a middle-aged, bearded man. A few years ago in Palm Springs, Calif., Goodman says, Blumenstein introduced the man to a group of attendees as the “donor’s representative.” He gave the man’s name as “Andrew.”

The unknown man’s donations to the fight against Huntington’s, it turns out, were just a small part of his generosity. A year ago, when I was trying to solve a different mystery, I noticed in an obscure Internal Revenue Service database the existence of two huge charitable funds known as Gabriel Trust and Endurance Funding Trust. They had been established on the same day in 2002. Together, these trusts hold about $9.7 billion. That’s one of the largest pools of philanthropic funding in the U.S., bigger than the Carnegie and Rockefeller foundations combined. Only three private foundations in the country—the Gates, Ford, and Getty foundations—are bigger.

But someone had taken elaborate steps to make sure no one figured out where this money came from, using layers of company subsidiaries to obscure its origins. Gabriel’s and Endurance’s reports to the IRS, on file with the agency in Ogden, Utah, showed the trusts were controlled by companies in Nevada and Wyoming, using the addresses of local law firms. The companies, in turn, proved to be controlled by others in Delaware. I kept digging. Finally in August, a sheaf of papers I’d requested arrived in the mail from the Delaware Office of the Secretary of State. They showed that the man behind the companies that control Gabriel was Andrew Shechtel of Princeton, N.J.

Shechtel had but the slimmest profile on the Internet. A search result suggested he was involved with a hedge fund called TGS Management, about which practically nothing had been written. Over the following months, documents and interviews filled in the rest of the story: He and two other men, all highly gifted in math, had started TGS in 1989 after the firm that had employed them dissolved in scandal. TGS pursued a style known as quantitative, or “black box,” investing, using computers to identify trades. The trio quickly made a fortune. Since they had few outside investors, few heard about their success.

The men took pains to keep a low profile. Nowadays, even among competitors and recruiters in the quantitative-investing field, dropping the name TGS usually draws a blank. What’s more, Shechtel and his partners, David Gelbaum and C. Frederick Taylor, sought to give much of their fortunes away in near-total secrecy, using separate anonymous vehicles including the trusts above to direct more than $13 billion to causes such as human rights, the environment, and disease research. One of the most powerful forces in American philanthropy is a shadow.

Gelbaum, 65, retired more than a decade ago, leaving Taylor and Shechtel, both 54, to run TGS. None was interested in talking to a journalist. Shechtel operates from a nondescript suite in downtown Princeton. Taylor lives in a gated enclave a few miles from the hedge fund’s West Coast office in Irvine, Calif. Before dawn one day in March, I peered through a black metal fence into the compound in Irvine where TGS keeps banks of computers. The place was on a dead-end street between a sandy creek bed and a carwash. A row of pines flanked a cluster of timber and glass buildings. From somewhere inside the compound, machinery whined.

Over the past few decades, the rise in the fortunes of the country’s richest people has created a golden age in philanthropy, comparable to the one that spawned the Carnegie and Rockefeller foundations a century ago. The Bill & Melinda Gates Foundation, the country’s biggest, is spending billions to end polio and to transform the U.S. education system. Alice Walton, an art lover and heiress to the Wal-Mart retail fortune, built a world-class museum in small-town Arkansas. Gordon Moore, the Intel co-founder, is spending $250 million to construct the world’s largest telescope on a mountain in Hawaii.

Because Congress offers tax deductions for philanthropy, this growing breed of donor is deciding the fate of billions of dollars that would otherwise flow to the government. Individual charitable deductions will cost the Department of the Treasury $43.6 billion in foregone revenue this year, a congressional panel estimates. Partly because of the tax subsidy for philanthropy, the IRS has long required private foundations to publicly state who controls and funds them. This is fine with most big donors, who don’t want to hide their gifts. They want recognition or a legacy, or they want to help publicize their cause. Shechtel, Taylor, and Gelbaum are the exceptions to the rule. By masking their philanthropy, they aren’t just shunning accolades and speeches at charity galas. They’re also avoiding public scrutiny of how they made their fortunes, and how they’ve chosen to give them away, including some donations with political consequences.

A Tangled Web of Charity

Experts point to only a handful of historical analogues. George Eastman, founder of Eastman Kodak, donated under the name Mr. Smith before he was unmasked in 1920. In the 1980s, Charles Feeney, who made a fortune running duty-free shops, began giving almost every penny away in secret, a story later recounted in a biography, The Billionaire Who Wasn’t.

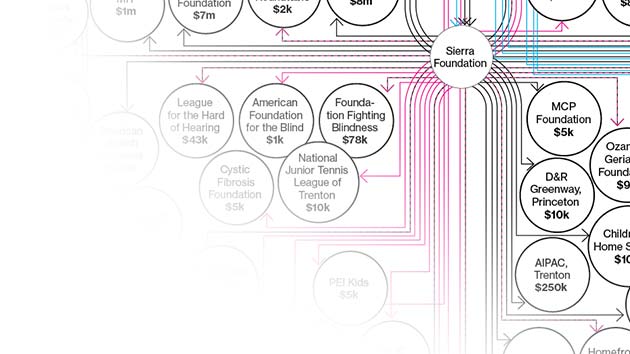

“You haven’t heard very many of these stories,” says Paul Schervish, the director of Boston College’s Center on Wealth and Philanthropy. “There are many factors that lead away from anonymity.” For more than two decades, the TGS partners have coordinated their philanthropic efforts with the help of lawyers at Lowenstein Sandler in Roseland, N.J. As the scale of the giving increased, the law firm helped them take legal steps to hide their work from public view. From 1999 to 2005, Lowenstein Sandler established more than a dozen anonymous private foundations, funded and controlled by limited liability companies. According to IRS filings, almost all of these companies have links to either Shechtel, Gelbaum, or Taylor, and they have enigmatic names such as Lotsa and Shekel Funding. One of the foundations is called the Matan B’Seter Foundation, Hebrew for anonymous gift.

Gregory Colvin, a San Francisco lawyer who’s practiced nonprofit law for 40 years, says using intermediaries to disguise a private foundation’s backers is extremely unusual. It’s contrary to the spirit, though probably not the letter, of the private-foundation rules, Colvin says. “Most of us who practice in the tax-exempt arena would regard setting up a private foundation as a full-disclosure vehicle,” he says.

Since 2000, IRS filings show, these foundations have distributed more than $1.8 billion to charity, including more than $700 million to combat Huntington’s. An additional $1 billion has flowed to pools such as the Vanguard Charitable Endowment Program, which distributes funds for thousands of donors, making the ultimate destination of the TGS partners’ money impossible to determine. Billions remain to be disbursed.

Shechtel, Taylor, and Gelbaum found their way to each other thanks to a math professor and frustrated gambler named Edward Thorp, who developed one of the first systems for counting cards at blackjack. After getting kicked out of a few Nevada casinos, Thorp started the world’s first quantitative hedge fund, Princeton-Newport Partners, in 1969, using computers to identify mispriced securities and profit from them. Princeton-Newport made money every year, attracting prominent investors such as Harvard University. An atmosphere of a university research lab prevailed in Thorp’s Newport Beach (Calif. ) offices, with casually dressed Ph.D.s puzzling over mathematical formulas and computer code. Across the country in Princeton, a former stockbroker named James Regan carried out trades and dealt with Wall Street.

Gelbaum was one of Princeton-Newport’s earliest hires, a mathematics major whom Thorp says he hired away from a muffler repair shop in 1972. Short, soft-spoken, and cerebral, Gelbaum was passionate about environmental conservation and showed little interest in money.

Taylor arrived in Newport Beach in the early 1980s. A clean-cut East Coaster with an economics degree from Haverford College, he found his way to Thorp through his wife, a college friend of Thorp’s daughter. Articulate and socially at ease, Taylor stood out in an office full of scientists and mathematicians, says Jerome Baesel, a finance Ph.D. who helped run the Newport Beach office. Baesel says Taylor looked like a young F. Scott Fitzgerald. Taylor distinguished himself in the work. “He solved some problems in programming that I’m pretty sure a large proportion of the finance professors in the country couldn’t solve,” Baesel says. Soon, Taylor was tapped to handle research for a new arbitrage project, profiting from discrepancies between the prices of stock and convertible bonds. Taylor and Gelbaum began to spend a lot of time together, kicking around ideas.

Shechtel joined Princeton-Newport’s Princeton branch in the mid-’80s. A son of civil servants in the Maryland suburbs, he had entered Johns Hopkins University around the time he turned 16, graduating at 19 with degrees in math and political economy. He arrived in Princeton after Harvard Business School and a job on Wall Street. “He chuckled a lot,” Baesel says. “If he had an idea, he would throw it out and see how people responded to it and have a big laugh over it.”

Some of these ideas were fairly convoluted. Before he started at Princeton-Newport, says a former co-worker who spoke on condition of anonymity, Shechtel figured out how to legally arbitrage the dividend reinvestment plans that some companies offered on their stock. Because companies set limits on the amount of discounted stock each individual shareholder can buy through the plans, the project involved forming dozens of shell companies to take advantage of the discounts at little risk of loss. At Princeton-Newport, Shechtel found success in closed-end funds, another little-known corner of the securities industry. An arbitrageur can sometimes profit by buying stakes in these listed investment pools and forcing them to liquidate. Managers often resist, so success requires the stomach for a fight. Shechtel took on a series of British funds and turned a profit on the deals.

Then in December 1987 federal agents raided the Princeton office and carted away dozens of boxes of trading records. The next year they indicted co-head Regan and four other employees on racketeering and tax-fraud charges. Prosecutors tried to compel Regan and his colleagues to testify in their sprawling case against Michael Milken, the Beverly Hills junk-bond king. Regan maintained his innocence, and eventually the charges were dropped against all five. But it was too late. The bad publicity proved fatal to Princeton-Newport. Investors pulled their money, and Thorp, who wasn’t accused of any wrongdoing, cut his ties with the firm. Shechtel, Taylor, and Gelbaum weren’t accused of any wrongdoing in the federal case either. When they started TGS in 1989, they kept many of the former Princeton-Newport employees and investors.

Now 81 and still playing the markets in Newport Beach, Thorp says he lost touch with his former protégés after the firm collapsed, although he occasionally hears about them through the grapevine. The word is that they’ve done very well. Given their history with Princeton-Newport, he says he’s not surprised they prefer a low profile. “Some people like to strut and brag, and some people like to be very careful and quiet,” he says. “One of my friends once said, the whale is never harpooned until it spouts.”

According to Thorp, when the TGS partners started trading, they pursued a form of statistical arbitrage. In its simplest form, statistical arbitrage seeks to profit from the tendency of stocks that recently fell to rise, and stocks that recently rose to fall. Within a few years, the hedge fund had made enough to return money to most of its outside investors, according to Thorp and another person with knowledge of its activities. Without having to further solicit outsiders for money, they’d rarely have to tell anyone about their investment strategies. The three men could focus on multiplying their own funds in privacy.

TGS surfaced briefly in the press in the late ’90s. Resurrecting Shechtel’s strategy at Princeton-Newport, it mounted an arbitrage campaign against several Scottish closed-end funds, buying stakes in undervalued funds and pushing for changes or liquidation. At least one fund was forced to dissolve. The British press dubbed the firm a “secretive U.S. vulture fund.”

Shechtel still works from the old Princeton digs, where federal agents barged into his office a generation ago. The office at 33 Witherspoon St. is located off a windowless third-floor corridor beyond a security camera, an American flag, and a sign warning, No Soliciting.

In Irvine, Taylor presides over an office campus that’s preserved the research lab atmosphere Thorp created at Princeton-Newport. When I visited in March I saw young men in backpacks and jeans wander in and out. According to Glassdoor.com, the grounds feature a gym and a rock-climbing wall. A former Google recruiter oversees the hiring of Ph.D.s and computer programmers, according to his LinkedIn page. Sample interview question: “For any prime number larger than 3, prove that p^2-1 is always divisible by 24.” City documents show the office recently expanded to more than 40 employees.

“Because of the nature of that business, there’s a lot of concern about security,” says Thomas Tritton, a former Haverford president who once visited Taylor’s office on a fundraising trip. “The trading algorithms you use—you don’t patent these things. You are protected only by secrecy.”

John Taylor joined the Landmine Survivors Network’s board and “kept a pulse” on the organization’s activities, while Fred became one of the group’s biggest donors, Rutherford says. “Without the Taylors, we would not have achieved as much as we achieved.” The organization wound down in 2010, and Rutherford says he never met Fred and never learned anything about him or the origin of his wealth. “I never asked,” he says. “I think it was self-made. I don’t think it was inherited—he and John were sort of in different boats.” John’s role as a public face of his brother’s hidden giving was formalized in 2000. That year, John and another Taylor brother, W. Myles Taylor, formed a consulting firm known as Wellspring Advisors.

Wellspring sometimes refers to itself as an “advisory firm representing anonymous donors.” Members of its staff, which has grown to about 50 in New York and Washington, are forbidden from discussing the source of the funds. Matan B’Seter, one of the anonymous funds set up by Fred, pays Wellspring an annual fee for services, amounting to $13 million in 2012, according to an IRS filing.

Wellspring’s website says its goal is to “advance the realization of human rights and social and economic justice for all people.” In recent years, Wellspring has worked on preventing AIDS in Asia, supporting people with disabilities in South America, and boosting graduation rates in U.S. high schools. Fred broke with his habit of working in anonymity in 2011, when he helped his son, Joshua, set up an after-school program, 9 Dots, and took a seat on the charity’s board. The nonprofit gives middle-school kids in a poor section of Los Angeles access to computers and science instruction.

In a spacious education center in Hollywood that Fred refurbished and leases to 9 Dots at no cost, children in grades three through eight work on computers. The program is free, and there’s already a long wait list. When I rang the buzzer at 9 Dots in March, a young man in jeans and a gray sweater came to the door. “Sorry, I was told not to say anything,” he said.

He introduced himself as Joshua Taylor. He wouldn’t say anything about his family, but he answered a few questions about 9 Dots as we stood outside the door in a courtyard that smelled of freshly cut cedar. His aim is to expose underprivileged kids to science, technology, engineering, and math. “That’s where the best opportunities of the 21st century are—if kids don’t get exposure to STEM, they can’t take advantage of those opportunities,” he said, his hands in his pockets. “I think everyone deserves a shot.”

The pursuit of secrecy hasn’t kept the TGS partners from dipping their toes into politics. The hedge fund lobbied Congress on tax policy for three consecutive years a decade ago, even submitting a wish list of tax law changes to the House Committee on Ways and Means in 2001. Among other things, they wanted to provide more generous tax treatment for donors who target rare diseases and for donors who contribute securities such as bonds to a private foundation.

The partners’ causes aren’t always aligned. Sweetfeet Foundation, established by Shechtel in 1993, has given to the Hudson Institute, a conservative think tank. According to court records in Maryland, Taylor’s brothers at Wellspring have directed funding to a program run by Sanford Newman. Newman, a liberal activist, is best known for founding Project Vote, which encourages minorities to participate in elections. Around the same time he was setting up Wellspring, John, a longtime resident of the East Coast, made a foray into California politics. A company called Freba Fay, registered to his home in Philadelphia, contributed $220,000 to ballot initiatives in California. Freba Fay opposed a ban on gay marriage, which passed anyway, and supported a successful proposition to reduce traffic.

The spending attracted enough notice that the Los Angeles Times wrote a story about the mystery and tracked down John. In the Times, John described Freba Fay’s backers as philanthropists who wished to remain anonymous. He wouldn’t say more. “I am not going to play 20 questions with you,” he told the newspaper.

Unlike his former partners, Gelbaum is done with philanthropy. He’s already given away most of his fortune and lost much of the rest. Not long after he retired from TGS, a Los Angeles Times report identified him as the anonymous donor who’d been bankrolling the Sierra Club and helped a conservation group buy a large chunk of the Mojave Desert. He acknowledged the gifts and has since disclosed more than $1 billion in giving, including support for Iraq and Afghanistan war veterans and the American Civil Liberties Union. In a handful of interviews, he’s avoided saying much about the source of his wealth.

“I don’t think that if you have a lot of money and you give away a lot of money, you should get a lot of recognition,” he told the Los Angeles Times in 2004. “You shouldn’t be able to buy that.” His investing success, he told the newspaper, was “all a matter of chance. It certainly wasn’t because I worked 5,000 times as hard as the average person, or was 5,000 times smarter than the average person.”

After leaving TGS, Gelbaum bet heavily on green technology: biofuels, solar panels, smart grids. The New York Times reported in 2010 that he’d invested $500 million of his fortune in green companies and given away or paid in taxes most of the rest. He took a role that year as chief executive officer of Entech Solar, a Texas company he’d been supporting financially.

In 2012, the company announced that it was running out of cash and that Gelbaum had stopped propping it up. Other companies in his portfolio faced challenges. The next year, he and his wife announced they were “not in a position to give more” to charity. Nor did they expect they’d ever be. “He lost more than he expected to in the financial crisis,” says his lawyer, Joseph Bartlett, “more than he thought he could possibly lose.”

One March afternoon in Miami Beach at a conference on Jewish philanthropy, Shechtel stretched out on a hotel deck chair by a pool looking out over the beach. Earlier that day, his wife, Raquel, had given a presentation on encouraging Jewish teens to donate to charity. The hotel was crawling with fundraisers, but when I asked half a dozen conference attendees about Shechtel, none had heard of the guy. They didn’t know they were in the presence of one of the country’s biggest Jewish philanthropists.

Shechtel leaned forward and smiled when I approached. His collar was open, and he had a round face and a close-clipped black beard flecked with white. He wore bright orange socks. When I introduced myself, his expression changed. He didn’t want to talk. He dismissed me with a few words and turned away. He just wanted to be another guy by the pool, watching the shadows stretch out over the sand.